We give you savings options that help craft financial success.

We are here to help you achieve your savings goals.

We have a wide selection of products to help you save.

Membership starts with a savings account.

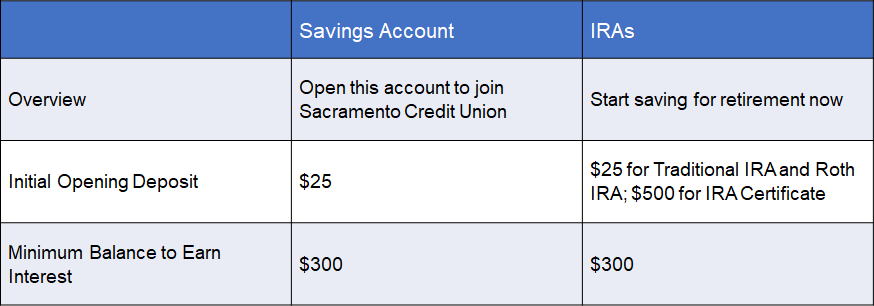

Everything starts with a Savings Account. Opening this account makes you a Sacramento Credit Union member, allowing you to access our other valuable products and services. It’s also an account that can help you strengthen your savings foundation, growing your deposits at a competitive interest rate.

- $25 opening deposit

- Earn interest each month with a $300 minimum daily balance.

- Dividends calculated on the average daily balance and paid monthly.

Want to learn more?

Scan the QR Code with your phone and view more content! It only takes a minute, and you’ll have the e-brochure on your phone. Ready to view or share!

Or come talk with us right now!